The politically exposed persons (or so called PEPs) screening process is part of the duties of the compliance officer. It should be carried out on a regular basis and with a high degree of responsibility.

But wouldn’t it be MARVELous if every politically exposed person would heed the timeless wisdom encapsulated in the phrase: “With great power comes great responsibility”.

Politically exposed action hero to fight evil – a visionary tale for every voter. Regrettably, not all PEPs embrace their role as defenders of the nation. Rather the totally opposite might be true – with great power comes great temptation to abuse this power for corruption.

This doesn’t imply that all PEPs are criminals. Rather, it emphasizes the necessity for all PEPs to undergo enhanced client due diligence, ensuring that the potential for abusing power is mitigated. For enhanced client due diligence automatic PEP screening process is a critical step to ensure that all the PEPs are properly determined.

In this guide, we’ll take you through the ins and outs of politically exposed person screening. And topic of how a company like AMLYZE can help strengthen your financial defenses.

Understanding PEP: why the emphasis?

Corruption is an insidious plague that has a wide range of corrosive effects on societies. It undermines democracy and the rule of law, leads to violations of human rights, distorts markets, erodes the quality of life and allows organized crime, terrorism and other threats to human security to flourish.

United Nations Convention against Corruption

Politically exposed persons are individuals who are, or have been, entrusted with prominent public functions, their family members and close associates, and includes both domestic and foreign PEPs. They generally include heads of state and government, politicians, judges, military personnel, and senior executives of state-owned enterprises. In addition organizations owned or controlled by PEPs are also considered to be at higher risk due to indirectly inherited political trust.

The PEP label doesn’t imply illegal activity, but their high-profile position and influence can potentially be misused for corruption. Global AML/CFT standard setters (such as Financial Action Task Force, FATF) requires institutions to have appropriate risk management systems in place to determine whether customers are PEPs, related or close associates to a PEP, and, if so, to take enhanced customer due diligence measures.

FATF assessment

The effective implementation of AML/CFT requirements for PEPs has posed significant challenges for institutions worldwide, as evidenced by the outcomes of assessments conducted by FATF (or FATF-style regional bodies), depicted in the table below. Notably, even countries with high corruption perception indices, such as France, Japan, and the USA, have not escaped stringent evaluations of their PEP control measures. While specific issues may differ from one country to another, a common thread prevails: the absence of robust enhanced due diligence requirements for PEPs.

FATF assessment of PEP distribution

| FATF evaluation on politically exposed persons | Jurisdiction (click on the country name in the table to go directly to the report on the FATF website or click here for FATF consolidated data) |

|---|---|

| Partially compliant to international standards - there are moderate shortcomings: | United States, Japan, Slovakia, Bulgaria, France, Korea, Monaco, Armenia, Benin, Cameroon, Central African Republic, Chad, China, Côte d'Ivoire, Democratic Republic Congo, Eswatini, Gabon, Gambia, Georgia, Grenada, Guinea, Guinea-Bissau, Haiti, Hong Kong, China, Kenya, Liberia, Madagascar, New Zealand, Niger, Nigeria, Palau, Republic of the Congo, Romania, Russian Federation, Samoa, Senegal, Solomon Islands, Tajikistan, Togo, Turkmenistan, Uzbekistan, Venezuela |

| Non-compliant to international standards - there are major shortcomings: | Algeria, Lao PDR, Namibia, Tanzania, Tonga, Vietnam |

It’s indisputable that you can’t proceed with enhanced due diligence measures unless you establish their necessity. Put simply, if you’re unsure whether your client is a PEP, you’re facing an issue. Of course PEP automatic screening is just one component of the solution. But having one in place is certainly a good starting point.

The regulatory backbone

Every PEP is a civil servant. Not every civil servant is a PEP.

AMLYZE

There’s a lot of gray area in what it means to be a prince

Genie from Dysney’s live action movie Alladdin

The cornerstone of identifying an individual as a PEP lies in the regulatory definition of “prominent public function.” Typically, the seniority of the public function serves as a trigger for setting regulatory PEP requirements. However, interpretation of “seniority” can vary across jurisdictions, leaving a gray area for determining if a person is a PEP.

Naturally, individuals occupying high-ranking positions such as heads of state or government, ministers, members of parliament, and chief commanders of armed forces are unequivocally included in the PEP definition. Conversely, lower-level public servants like municipal clerks are unlikely to be considered PEPs.

Ambiguity may emerge across various jurisdictions when discerning whether certain individuals, such as high-ranking police officers, members of municipal administrative bodies, senior management in public companies, or members of political parties (among other potential examples), qualify as prominent public functions. Despite concerted efforts, such as those seen at the EU level, to harmonize lists of prominent public functions, disparities in interpretation persist, even within the EU.

Imposition of time limits

Another factor that could obscure the understanding of PEP status is imposing time limits on determining if a person is still a PEP after leaving the position. Suppose an individual is a former head of government. Should he/she be regarded as a PEP, and if so, for how long? For instance, the FATF proposes a potentially indefinite approach (“once a PEP – always a PEP”).

There are jurisdictions that follow the conservative approach, e.g. Canada’s AML/CFT regulation indicates that once you determine that a person is a foreign PEP, they remain a foreign PEP forever. In certain jurisdictions, individuals may retain their classification as PEPs even after their passing.

In cases where a deceased PEP served as the source of funds or wealth for close family members or associates, a risk-based assessment becomes necessary to ascertain whether those relationships still warrant heightened Enhanced Due Diligence (EDD) measures based on their individual merits, or if they should be reclassified.

Factors to consider

A softer approach is applicable for EU countries: EU AMLD (short version for AML Directive) requires organizations to assess the ongoing risk posed by a PEP for at least 12 months after their tenure in a prominent public role.

What implications does this hold for automated PEP checks? Several factors should be carefully considered in line with regulatory approaches:

- it’s crucial to carefully select datasets for initial screening. This involves verifying whether the definition of PEP employed by database providers aligns with the definitions used in specific countries.

- determining if the PEP filtering criteria should incorporate considerations such as the date of a PEP leaving the office. Factoring in this information may significantly reduce the number of alerts, contingent upon local regulations permitting such criteria adjustments.

Building a robust PEP screening framework

What’s Cookin’ Doc?

Bugs the bunny, Merrie Melodies

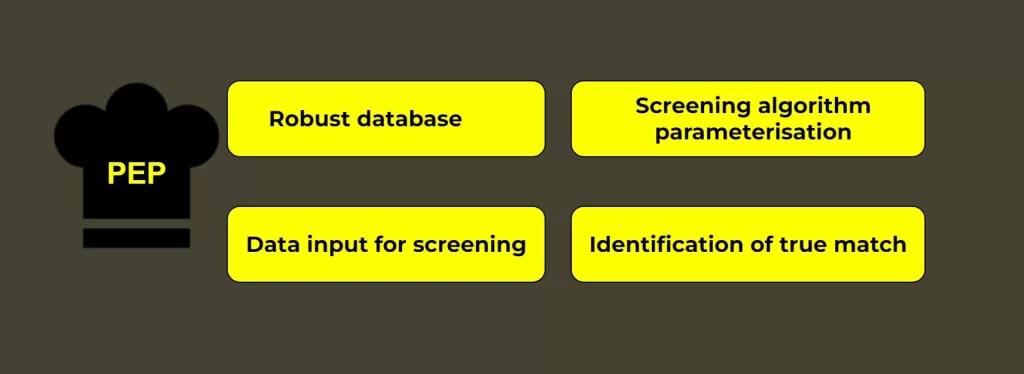

So what ingredients should you have in mind while choosing a recipe for an effective politically exposed person screening? We hope the following ingredients will help you to cook a best suited solution.

Commercial databases po PEP screening

A robust PEP screening framework starts with obtaining accurate PEP lists from reliable data providers. These lists, which contain detailed information such as the PEP’s name, position, and country of origin, are the cornerstone of effective screening. There are a variety of commercial databases available which may assist in the detection of PEPs.

It is worth, however, mentioning that using the automatic screening solutions cannot replace the due diligence of the client for few specific reasons.

The construction of PEP datasets results from meticulous research and gathering information from government or other reputable sources. Commercial database providers continually update PEP lists and scour various information sources. However there is no one unified dataset that would include all the worldwide PEPs.

The case of Rodulgin

Regulatory requirements for enhanced customer due diligence should extend to family members and close associates of PEPs in the same manner as for the PEPs themselves. However, this presents a challenge. Acquiring information on PEP family members is often difficult for commercial database providers. Even more challenging (or even impossible) is to acquire information on close associates of PEPs. Let us give you an example.

Consider the case of the renowned Russian cellist Sergei Roldugin. When the extensive money laundering scheme orchestrated (pun intended) by Mr. Roldugin was exposed, discussions arose about his unmistakable relationship with Vladimir Putin, the President of Russia. However, reflecting on the time when Mr. Roldugin was opening accounts in financial institutions, could he have been identified as a close associate of a PEP? Let us leave the question unanswered.

Suggested composition

While using commercially available PEP databases for screening, institutions should ensure that information on these databases is up to date and that they understand the limitations of those databases. According to Wolfsberg Group Guidance on Politically Exposed Persons (PEPs), PEP database used for screening should contain the following:

- name (all known names and aliases);

- year of birth;

- country of political exposure;

- gender (where available)

- politically exposed role(s), and date(s) or year(s) of appointment;

- date or year that the PEP left their position.

Data input for PEP screening process

Similar to any automated system, PEP screening solutions depend on source data – the information inputted into the system for analysis. Data availability and quality are crucial determinants for analytical software to generate meaningful results. It’s essential that the data collection, extraction from the source system, and loading into the screening system are conducted in a manner that preserves data integrity.

We will not delve into the complexities of extracting data from the source systems and loading it into the politically exposed person screening system. Instead, we’ll focus on key aspects of data collection. The effectiveness of identifying whether customers or beneficial owners are PEPs relies entirely on the thorough implementation of Customer Due Diligence (CDD) measures. Insufficient data collection will hinder the effectiveness of the PEP screening process.

PEP check examples to consider

We have previously discussed the challenges of identifying customers with political connections, such as determining if they are relatives or close associates of PEPs. Another consideration is the extent to which a PEP’s influence can extend to a legal entity, prompting it to be subject to the same scrutiny as the PEP themselves. Few examples to take into account what should be screened for legal entities:

- the beneficial owners of the client;

- other relevant links to a PEP that exercise significant control over the customer, for example are any of the customer’s directors or management board members PEPs;

- our recommendation is to not overlook former directors and beneficial owners. It’s often observed that shares are transferred to relatives or close associates immediately after election results are announced. This could suggest an attempt by a PEP to avoid being identified as one, and the share transfer agreement may be fictitious, enacted solely to evade potential enhanced due diligence measures for the entity;

- other individuals that have control over the account.

Parameterization of PEP screening algorithm

The effectiveness of the screening algorithm depends on numerous of variables which we have already covered in our previous case study (please refer to our case study: “10x improvement in sanctions screening: VIALET case”). Given the significant overlap between sanctions and politically exposed person screening, we won’t reiterate those similarities here. However, we offer the following tips for optimizing the parametrization of PEP screening:

- Determine regularity of screening. According to Wolfsberg Group Guidance on Politically Exposed Persons (PEPs), PEP screening process should be performed in accordance with an institution’s risk appetite applying a risk-based approach and take place at least: as part of the onboarding process, at periodic customer review; when there is a trigger event which warrants a customer due diligence review. There is no necessity to have a daily PEP screening process. However for the sake of process simplicity some institutions choose to have a screening on a daily basis.

- Define the scope of screening targets. While transaction counterparty screening for sanctions is typically advised, the same level of scrutiny isn’t always required for PEP screening. Although compliance representatives may contemplate adopting a more cautious risk management strategy, our experience indicates that transaction counterparty PEP screening often yields a high number of false positives and falls short of delivering anticipated risk mitigation outcomes.

- Decide if different parameters are needed for different screening targets. If opting for transaction counterparty screening, a potential solution to mitigate the burden of false positives is to employ parameterization closer to an “exact match” criteria.

- Determine if PEP status termination should be taken into account by the screening algorithm. While determining the PEP status termination parametrization, take into account the local regulatory requirements.

These are only a few tips to move forward with PEP screening optimization. For more tips please refer to our case study “10x improvement in sanctions screening: VIALET case”.

Identification of true match

If the automated screening solution identifies a match to a PEP, the system should alert the appropriate personnel. They should conduct further investigation to confirm the match. Although the screening system may operate effectively, regulatory nuances regarding what qualifies as a prominent public function may lead to the dismissal of a match as a false positive.

Consider the case of Mr. John Doe, who serves as a municipal clerk in country X. A commercial dataset provider includes public data records on all civil servants of country X. The screening algorithm accurately identifies Mr. John Doe as a PEP based on the dataset provider’s information. However, the individual reviewing the match dismisses it as a false positive, citing country X’s regulatory interpretation that municipal clerks are not considered as PEPs.

Indeed this is a very simplified example. While the regulatory requirements in country X may not classify Mr. John Doe as a PEP, an institution with a conservative risk-based approach might still choose to treat him as one. Ultimately, it’s at the discretion of each institution to determine its risk appetite.

Conclusions

Power tends to corrupt and absolute power corrupts absolutely. Great men are almost always bad men, even when they exercise influence and not authority; still more when you superadde the tendency of the certainty of corruption by authority.

Lord Acton

The road to effective PEP screening is challenging. It involves keeping up with updated data, managing large volumes, dealing with false positives, and staying updated on different regulations.

Partnering with experienced consultants and leveraging the advanced technologies offered by AMLYZE can significantly strengthen your politically exposed person screening process.

AMLYZE’s extensive expertise in evaluating and enhancing PEP screening processes, coupled with strong relationships with PEP data providers, will ensure that your organization stays ahead of the compliance game and protected from potential financial pitfalls.