In the realm of global business operations, adherence to a myriad of regulatory requirements is imperative to maintain a reputable standing and avoid legal entanglements.

Among these, sanctions screening emerges as a crucial aspect that acts as a deterrent against potential financial crimes and other malpractices.

Here in this article we aim to shed light on the importance, procedural dynamics, and innovative technological advances that are shaping today’s sanctions screening practices, providing a deeper understanding for businesses, especially within the financial sector.

Skyrocketing number of sanctions

The number of sanctions has skyrocketed over the past two years. One of the main reasons is the West’s response to Russia’s aggression in Ukraine.

In EU countries, the number of sanctioned individuals and organizations has increased by 142% in the last two years, from 4,445 to 10,740, according to data from the OpenSanctions database.

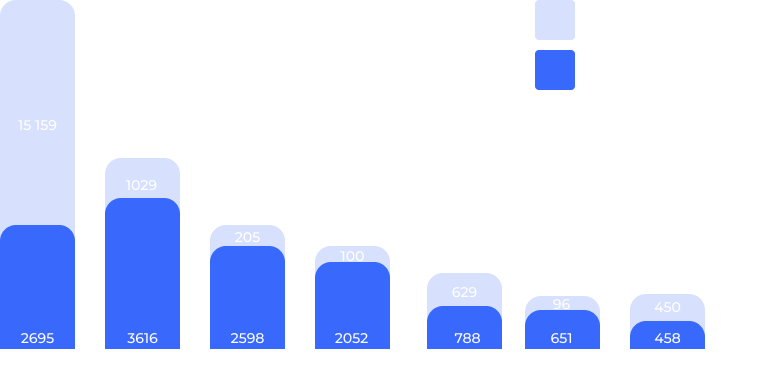

Number of sanctions imposed by EU countries on Russia

Since February 2022, Russia has led the list of the most sanctioned countries – about 15 000 sanctions have been introduced against Russia in Western countries (85% of all sanctions against Russia).

Russia tops sanctioned countries

Such a huge increase in sanctions creates a situation where it becomes technically extremely difficult for any company to achieve 100% sanctions compliance.

Understanding Screening

It is particularly important to understand that sanctions screening is a carefully crafted process that aims to match a list of names – individuals, organizations, or countries – against sanctioned or watch-listed individuals and entities. It serves as a safeguard measure to prevent engagement with parties potentially involved in illicit activities, in line with international, regional, and national regulatory requirements.

The indispensability of sanctions screening:

- Regulatory Compliance: Compliance with international and national sanctions regulations is non-negotiable for businesses to avoid hefty fines and legal repercussions.

- Risk Mitigation: Early identification and mitigation of risks associated with doing business with sanctioned or watch-listed entities is facilitated by a thorough sanctions screening process.

- Trust and Reputation: An uncompromising approach to sanctions screening underpins an institution’s commitment to ethical and compliant operations and fosters trust among stakeholders and the wider community.

- Processes Optimisation: A rigorously calibrated sanctions screening process enables institutions to reduce the time it takes to identify listed entities and reduces the number of false positives.

Critical steps

Sanctions screening involves several critical steps to ensure a thorough and compliant process:

- Customer Data Collection: Gathering relevant data on customers, transactions, and counterparties is the foundation of the sanctions screening process.

- Sanction or Watchlist Data Collection: Collect and enhance data published by trusted authorities prior to initiating the sanctions screening process.

- Screening: During this crucial phase, the data collected is compared with various sanction lists to identify potential matches.

- Alert Resolution: Any match or near-match triggers an alert that requires review and a decision on how to proceed.

- Reporting and Documentation: Documenting the entire screening process, results and actions taken is essential for audit trails and regulatory compliance.

Possible technological advancements

Like any other process, sanctions screening can be improved in a number of ways:

- Automation: The introduction of automation streamlines the sanctions screening process, ensuring timely compliance and reducing the scope for human error.

- Machine Learning (ML): ML technologies increase the effectiveness and efficiency of sanctions screening, skillfully reducing false positives and adapting to evolving data patterns.

- Blockchain: The use of blockchain technology enhances the authenticity and traceability of data, providing a secure and immutable record of transactions.

- Cloud Computing: The use of cloud-based sanctions screening solutions offers a scalable, cost-effective, and accessible way for companies seeking robust compliance mechanisms.

Conclusions

Navigating the intricate maze of regulatory compliance and risk management is a daunting endeavor for modern global businesses. Sanctions screening is proving to be a vital cog in this complex mechanism, providing a safeguard against potential legal ramifications and reputational damage.

Understanding and implementing a robust sanctions screening process, underpinned by the latest technological advances, is essential for companies seeking to maintain a reputable and compliant operational stance in the global arena.

This article serves as a beacon for organizations, helping them to decipher the complex landscape of sanctions screening and embrace a culture of compliance and ethical business practices.

Read here more about the sanctions screening module provided by AMLYZE.