Have you ever wondered how companies navigate the complex world of sanctions screening process? In today’s global business landscape, effectively managing sanctions check has become essential for organizations to ensure compliance with international regulations and mitigate risk.

By implementing best practices in sanctions screening and adopting a strategic approach, organizations can navigate this complex process with confidence.

In this blog post, we will explore the key steps and strategies involved in sanctions screening, backed by compelling statistics.

Understanding these practices will enable organizations to strengthen their screening capabilities and protect themselves from potential penalties or reputational damage. Let’s dive in and uncover the secrets to successfully navigating the sanctions screening process.

Understanding the importance of sanctions screening

Sanctions screening is a vital process that prevents companies from dealing with individuals, entities or countries that are subject to financial, economic and trade restrictions. The number of new sanctions has increased by thousands in recent years.

Russia tops sanctioned countries

Failure to comply with sanctions can have serious consequences, including hefty fines, reputational damage and legal implications.

Recent statistics show that fines for sanctions violations have reached billions of dollars over the past decade.

Key components and workflow of the process

To ensure a comprehensive screening process, organizations should establish a systematic workflow that includes sanctions checks, sanctions list screening and anti-money laundering (AML) compliance.

This process typically includes data collection, sanction list screening, false positive evaluation and suspicious activity reporting.

Implementing automated screening tools can significantly reduce false positives by up to 80%. Additionally, this increase in efficiency and reduction in operational costs can have a profound impact on your organization’s bottom line.

Best practices for effective sanctions screening include:

-

Robust data collection

Collecting accurate and up-to-date data is essential for effective screening. By leveraging reputable data sources and using intelligent data management solutions, organisations can streamline the process and ensure the reliability of their screening results. Some of the most prominent regulatory and sanctioning bodies are the United Nations (UN), the Office of Foreign Assets Control (OFAC), the European Union External Action Service (EU EEAS) or His Majesty’s Treasury (HMT).

-

Risk-based approach

Implementing a risk-based approach allows organizations to focus their screening efforts on higher-risk individuals, entities, products and geographic regions. This optimization of resources reduces the risk of missing potential matches while minimizing false negatives.

-

Regular monitoring and updates

Sanctions lists are frequently updated, making it critical for organisations to establish a robust monitoring system to ensure ongoing compliance. Regular reviews and updates to the screening process help maintain accuracy and effectiveness.

Measuring quality of sanctions screening

Automated screening solutions are essentially a set of algorithms used to compare one string of text with another to identify similarities that indicate a potential match.

Such matching doesn’t just apply to sanctioned individuals, but can extend to politically exposed persons, individuals on law enforcement watch lists, regulatory watch lists (including bans on specific services such as financial or gambling services) and even internal watch lists (e.g. individuals who may be identified as posing a higher risk of money laundering or terrorist financing).

Algorithms used in automated screening compare an entity’s operational data, such as customer and transaction information, with lists of names and other indicators of sanctioned parties.

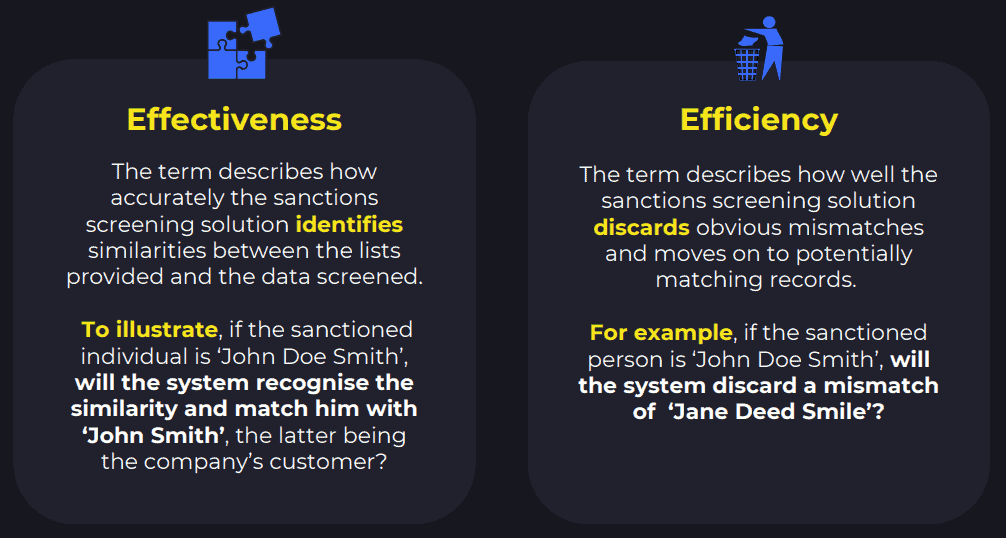

Best practice to measure quality of screening is effectiveness and efficiency. Let’s see more deeply what stands behind these terms.

- Effectiveness – the term describes how accurately the sanctions screening solution identifies similarities between the lists provided and the data screened. To illustrate, if the sanctioned individual is ‘John Doe Smith’, will the system recognize the similarity and match him with ‘John Smith’, the latter being the company’s customer?

- Efficiency – the term describes how well the sanctions screening solution discards obvious mismatches and moves on to potentially matching records. For example, if the sanctioned person is ‘John Doe Smith’, will the system discard a mismatch of ‘Jane Deed Smile’?

While these definitions may seem simple, both effectiveness and efficiency are critical to the businesses. Effectiveness ensures compliance with regulations, while efficiency ensures that the system works optimally.

Sanctions screening and AML regulations

Sanctions screening and AML compliance go hand in hand. By integrating AML practices into the screening process, organizations can effectively detect and prevent money laundering activities.

Failure to comply with AML regulations can result in severe penalties, including business closure and criminal charges. According to industry reports, global AML fines have exceeded $10 billion in recent years.

Navigating the sanctions check process is a critical endeavor for organizations seeking to maintain compliance and protect their reputation.

By following best practices such as implementing an automated screening system, regularly updating sanctions lists and configuring risk-based parameters, organizations can streamline their screening efforts and minimise the risk of regulatory breaches.

Both effectiveness and efficiency of automated sanctions screening solutions are critical for organizations. Effectiveness ensures compliance, while efficiency ensures that the system works optimally and does not overwhelm staff with false positives.

Adopting advanced strategies such as AI and ML techniques and continuous transaction monitoring will further strengthen the screening process. Remember, staying informed, proactive and adaptable is key to successfully navigating the ever-evolving landscape of sanctions screening and AML compliance.

Possibility to test the solution

You can also contact AMLYZE to test the quality of your company’s sanctions screening. We will test the sanctions screening solution regarding the agreed methodology and provide you with the results. The results will be compared with market benchmarks. Based on the test results, you will receive answers on how the screening process is positioned in your organisation and how it can be improved in relation to best practices.

Click here to read the blog post on the basics of sanctions screening. Or here to find out how one of AMLYZE’s customers improved their sanctions check process.