Money laundering is a global problem that affects businesses and individuals alike. Criminals use sophisticated methods to disguise the proceeds of illegal activities, making it difficult for law enforcement to identify and prevent these crimes. Fortunately, anti-money laundering (AML) software has become a critical tools in the fight against financial crime.

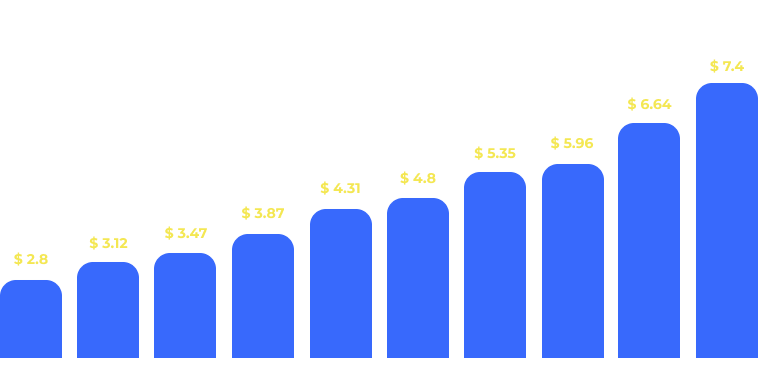

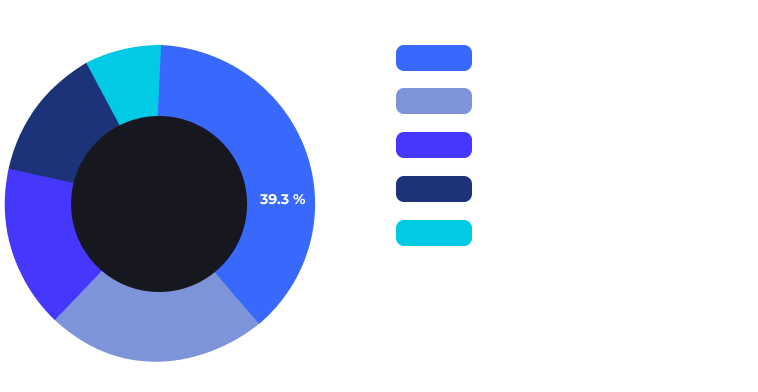

It is estimated that the global AML software market size was at $2.7 billion in 2022 and is expected to grow to $7.4 billion by 2030.

AML software market size today and expected growth, in USD billions

By way of comparison, according to the United Nations Office on Drugs and Crime, between $800 billion and $2 trillion money is laundered each year. That is equivalent to 2-5% of global GDP.

AML software plays a vital role by analysing customer data and transactions to detect suspicious behavior. In addition to monitoring transactions, AML software can also be used for risk assessment, which helps organizations identify potential areas of vulnerability.

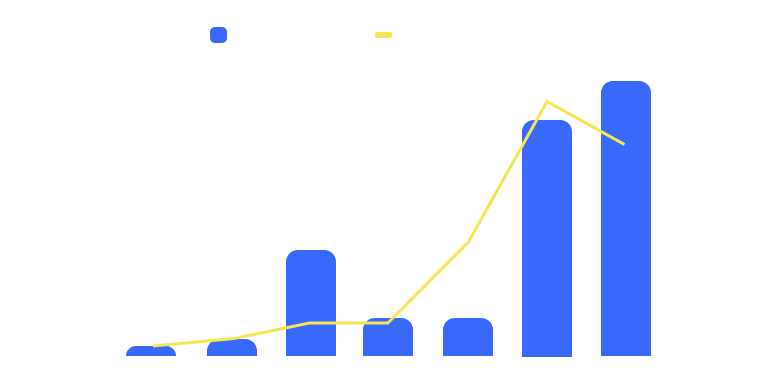

In terms of end-user share, banks, neobanks, insurance, and investment are the industries most likely to use AML software.

Global AML software market share by end user, 2021

Looking ahead, it’s important to keep abreast of the latest AML software trends to ensure your organization is equipped to tackle money laundering activities head on.

This software market is expected to continue to grow as regulatory pressures increase and more organizations look to adopt technology-based solutions to manage their compliance obligations.

In this blog, we will explore the trends that will have a significant impact in 2023 and beyond.

We will discuss how these trends can help your organization stay ahead of the curve and meet regulatory requirements. We will also provide insights on how to choose the right software solution for your business needs.

AML software for transaction monitoring

Whether you’re in banking, finance, insurance or real estate, AML software tools can help protect your organization from the devastating effects of financial crime. By detecting and preventing money laundering activity, this software can help protect your company’s reputation and avoid costly fines.

One of the key AML software trends to watch this year is transaction monitoring. AML transaction monitoring software is designed to help organizations identify and flag suspicious transactions in real time.

By analyzing transaction data, this software can identify patterns of behavior that may indicate money laundering. For example, if an individual makes several large deposits in a short period of time, this could be a red flag for money laundering.

AML transaction monitoring software can help organizations stay one step ahead of criminals by detecting suspicious transactions as they occur.

Risk assessment

Another AML software trend to watch is risk assessment software. AML risk assessment software is designed to help organizations identify and assess potential areas of vulnerability, depending on the customer, product, channel, and geographic location.

By analyzing customer data and transaction history, AML risk assessment software can identify high-risk customers and transactions.

This information can then be used to prioritize resources and focus efforts on the highest risk areas. If there are gaps present, it’s much easier and reliable to identify these gaps with software rather than manually.

Suspicious activities that risk assessment helps identify include:

- Tax evasion

- Fraud

- Terrorist financing

- Money laundering

Cryptocurrency regulation

Corporations, private citizens, and even some governments accepted cryptocurrency as an investment option.

Decentralization is arguably the best thing about cryptocurrency, and so is anonymity. However, with the latter, it presents significant regulatory challenges.

Money laundering is an issue that affects the crypto industry as well. As the market expands, so does the crime volume. The total value stolen in cryptocurrency hacks reached $3.8 billion in 2022.

Total value stolen in crypto hacks and number of hacks, 2016-2022

Crypto assets are becoming increasingly difficult to control. As a result, regulators are implementing new regulations to address the challenges.

In turn, cryptocurrency companies need to comply with national and international standards, and AML screening tools are an effective way to minimize risks.

Criminals are exploiting the crypto market because cryptocurrencies are still a relatively new concept. What’s more, the regulatory landscape is still evolving.

Anti-money laundering software is one way to monitor crypto transactions and ensure AML compliance.

It’s impossible to predict what will happen to crypto in the future, but for now, the market exists and needs to be regulated.

In addition to using AML software, organizations should keep abreast of the latest regulatory changes and other trends related to crypto. This will help them anticipate potential obstacles and allocate resources where necessary.

International screening

Reliable anti-money laundering tools ought to do more than simply gather data coming from international sources.

AML software should also have features to interpret and analyze the data. Many organizations deal with international transactions, and monitoring those is sometimes harder than monitoring local transactions.

Take non-western naming conventions, for example. Parties carrying out a transaction might come from countries that use Arabic, Cyrillic, or Mandarin language systems.

If a screening tool doesn’t provide a multilingual text analysis, the screening process might be put to a halt.

Nicknames, aliases, and other naming conventions in the international transaction information would be easier to investigate with a screening technology that interprets non-latin languages.

Global sanction compliance

Current and future geopolitical events play a major role in global sanctions compliance. State-sponsored cyber-attacks also need to be monitored.

The landscape is complex and organizations need to adapt to changing sanctions and regulations.

Financial crime screening and detection technology should be able to keep track of the latest sanctions and watch lists to flag profiles associated with criminal activity.

Intuitive name matching, pattern recognition, keyword and pattern recognition algorithms, and other machine learning capabilities enhance the system that already keeps track of global sanctions regulations while minimizing false positives.

Final thoughts on AML software

AML software tools has become an essential tool for organizations seeking to prevent money laundering activities.

AML solutions can help organizations comply with regulatory requirements and avoid hefty fines. It can also help organizations build a stronger reputation by demonstrating their commitment to preventing financial crime.

Although implementing an AML program may seem like a daunting task that requires a significant investment of time and resources, the benefits of using this type of software far outweigh the costs.

By investing in AML software, organizations can effectively protect themselves against the risks of financial crime and help create a safer and more secure financial ecosystem.

Essentially, this type of software enables organizations to stay one step ahead of criminals by detecting and preventing suspicious activity, protecting their reputation and avoiding hefty fines.

When looking for AML software, it’s important to choose a solution that meets your organisation’s specific needs.

Some solutions are designed for large financial institutions, while others are better suited to smaller organisations.

It’s also important to choose a solution that is easy to use and integrate with your existing systems. This type of software integrates with other compliance functions, such as KYC and sanctions screening, to provide a more comprehensive compliance solution.

AML software tools providers are offering cloud-based solutions, which can provide greater scalability, flexibility and cost savings.

In summary, AML software is critical to protecting organizations from the devastating effects of money laundering activities.

As we’ve discussed, transaction monitoring, risk assessment, cryptocurrency regulation, international screening, and global sanction compliance are AML software trends that organizations should look out for in 2023 and beyond.

These trends can help organizations identify suspicious behavior, prioritize resources, and reduce the risk of financial crime.